Deficit Owls | Currency Is An IOU of the Government @deficitowls5296 | Uploaded January 2017 | Updated October 2024, 4 hours ago.

Amar Reganti, former Deputy Director of the Office of Debt Management at the U.S. Department of the Treasury, discussing the question "what is a dollar bill?" If you look at all the accounting and logic, there is a simple conclusion: currency is a liability of the government. Or in non-accounting-speak, a dollar bill is an IOU of the federal government.

What does the government promise about its IOU? It doesn't promise any interest, nor does it promise to convert it to anything else. But it does promise to accept its own IOU to settle payments owed to the government. The largest of these is usually tax payments owed to the government. So, you can think of a dollar bill as a $1 tax credit.

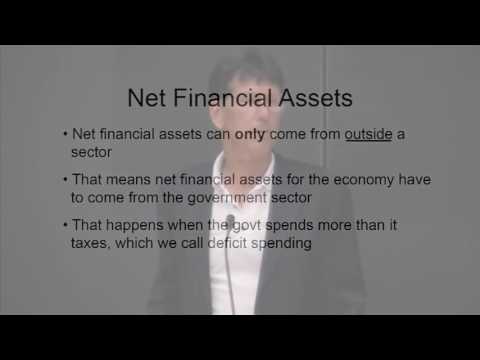

There are a few inescapable conclusions from this. For instance, if currency is a liability of the government, then clearly the government doesn't need to "get" its IOU from anybody before it is able to issue its IOUs to somebody else: the government doesn't need to tax or borrow first before it can spend.

In fact, take that a step further: you can't hold your own IOU as an asset. It would make no sense to create a million IOUs and then declare "I'm rich." Functionally, your IOU doesn't exist while its in your own possession. The paper IOU is just a recording of a promise, and there is no promise to anybody if you're holding your own IOU. So, the same thing applies to the government: when it takes back its own IOUs (like in tax payments), they are destroyed. When it writes IOUs (by issuing dollars when it spends), they are created. So, spending creates money, and taxing destroys it. What that tells you is that taxes don't "pay for" the spending.

And, it should tell you something about the "national debt." The national debt is just the collection of Treasury Bonds held by the public. Treasury Bonds are just another IOU of the government, just like currency. They are a slightly different promise, since they pay interest, and have a term after which the government pledges to convert them to currency; but they are IOUs all the same. So, government "borrowing" is really just the government swapping one IOU (currency/reserves) for another (bonds). Clearly swapping one IOU for another doesn't make you more able to issue IOUs (like when the government spends), and so we must conclude that "borrowing" can't "pay for" government spending either. So we conclude that bond sales are not a borrowing operation, and they must serve a different purpose. More on that here: youtube.com/watch?v=pex89N9Oqog&list=PLZJAgo9FgHWZzhpkjtMxIwZns26A0OdFz&index=12

At this point you might be wondering, what does the Federal Reserve do? Don't they "print money?" How can the Federal Reserve print money if government spending creates money?

The answer is that the Fed's job is to move back and forth between the two kinds of government debt, currency/reserves vs. Treasury bonds, based on the needs of the private sector for liquidity. A little more on that here: youtube.com/watch?v=-WywONy-Gvk&t=35s

See how bank money is in a parallel structure: your bank account is an IOU of your bank: youtube.com/watch?v=5ewr85A7AIs

If you need to brush up on the accounting terms, learn what a balance sheet is here: youtube.com/watch?v=ixCPM5HznRU&index=14&list=PLZJAgo9FgHWZzhpkjtMxIwZns26A0OdFz

Watch the entire talk here: youtube.com/watch?v=EyBhU19pD3k

Follow Deficit Owls on Facebook and Twitter:

facebook.com/DeficitOwls

twitter.com/DeficitOwls

Amar Reganti, former Deputy Director of the Office of Debt Management at the U.S. Department of the Treasury, discussing the question "what is a dollar bill?" If you look at all the accounting and logic, there is a simple conclusion: currency is a liability of the government. Or in non-accounting-speak, a dollar bill is an IOU of the federal government.

What does the government promise about its IOU? It doesn't promise any interest, nor does it promise to convert it to anything else. But it does promise to accept its own IOU to settle payments owed to the government. The largest of these is usually tax payments owed to the government. So, you can think of a dollar bill as a $1 tax credit.

There are a few inescapable conclusions from this. For instance, if currency is a liability of the government, then clearly the government doesn't need to "get" its IOU from anybody before it is able to issue its IOUs to somebody else: the government doesn't need to tax or borrow first before it can spend.

In fact, take that a step further: you can't hold your own IOU as an asset. It would make no sense to create a million IOUs and then declare "I'm rich." Functionally, your IOU doesn't exist while its in your own possession. The paper IOU is just a recording of a promise, and there is no promise to anybody if you're holding your own IOU. So, the same thing applies to the government: when it takes back its own IOUs (like in tax payments), they are destroyed. When it writes IOUs (by issuing dollars when it spends), they are created. So, spending creates money, and taxing destroys it. What that tells you is that taxes don't "pay for" the spending.

And, it should tell you something about the "national debt." The national debt is just the collection of Treasury Bonds held by the public. Treasury Bonds are just another IOU of the government, just like currency. They are a slightly different promise, since they pay interest, and have a term after which the government pledges to convert them to currency; but they are IOUs all the same. So, government "borrowing" is really just the government swapping one IOU (currency/reserves) for another (bonds). Clearly swapping one IOU for another doesn't make you more able to issue IOUs (like when the government spends), and so we must conclude that "borrowing" can't "pay for" government spending either. So we conclude that bond sales are not a borrowing operation, and they must serve a different purpose. More on that here: youtube.com/watch?v=pex89N9Oqog&list=PLZJAgo9FgHWZzhpkjtMxIwZns26A0OdFz&index=12

At this point you might be wondering, what does the Federal Reserve do? Don't they "print money?" How can the Federal Reserve print money if government spending creates money?

The answer is that the Fed's job is to move back and forth between the two kinds of government debt, currency/reserves vs. Treasury bonds, based on the needs of the private sector for liquidity. A little more on that here: youtube.com/watch?v=-WywONy-Gvk&t=35s

See how bank money is in a parallel structure: your bank account is an IOU of your bank: youtube.com/watch?v=5ewr85A7AIs

If you need to brush up on the accounting terms, learn what a balance sheet is here: youtube.com/watch?v=ixCPM5HznRU&index=14&list=PLZJAgo9FgHWZzhpkjtMxIwZns26A0OdFz

Watch the entire talk here: youtube.com/watch?v=EyBhU19pD3k

Follow Deficit Owls on Facebook and Twitter:

facebook.com/DeficitOwls

twitter.com/DeficitOwls